- Defend & Conquer

- Posts

- Key strategies for aligning internal controls with PCI DSS 4.0 security requirements in financial services organizations

Key strategies for aligning internal controls with PCI DSS 4.0 security requirements in financial services organizations

CybersecurityHQ Report - Pro Members

Welcome reader to a 🔒 pro subscriber-only deep dive 🔒.

Brought to you by:

👣 Smallstep – Secures Wi-Fi, VPNs, ZTNA, SaaS and APIs with hardware-bound credentials powered by ACME Device Attestation

🏄♀️ Upwind Security – Real-time cloud security that connects runtime to build-time to stop threats and boost DevSecOps productivity

🔧 Endor Labs – App security from legacy C++ to Bazel monorepos, with reachability-based risk detection and fix suggestions across the SDLC

📊 LockThreat – AI-powered GRC that replaces legacy tools and unifies compliance, risk, audit and vendor management in one platform

Forwarded this email? Join 70,000 weekly readers by signing up now.

#OpenToWork? Try our AI Resume Builder to boost your chances of getting hired!

—

Get lifetime access to our deep dives, weekly cyber intel podcast report, premium content, AI Resume Builder, and more — all for just $799. Corporate plans are now available too.

Executive Summary

The Payment Card Industry Data Security Standard (PCI DSS) 4.0 represents a fundamental shift in how financial services organizations must approach payment card security. Released in March 2022 with mandatory implementation by March 31, 2025, this standard moves beyond prescriptive checklists to embrace flexibility, continuous security, and risk-based approaches. For Chief Information Security Officers (CISOs) in financial services, aligning internal controls with PCI DSS 4.0 requirements demands a comprehensive strategy that integrates technical controls, process improvements, and governance frameworks.

This whitepaper examines key strategies for effective alignment, drawing from recent research, industry best practices, and implementation experiences across financial institutions. Our analysis reveals that successful alignment requires three interconnected approaches: strategic frameworks that leverage maturity models and integrate established cybersecurity standards; technical controls including encryption, tokenization, and automated compliance monitoring; and robust compliance management practices embedded throughout the organization.

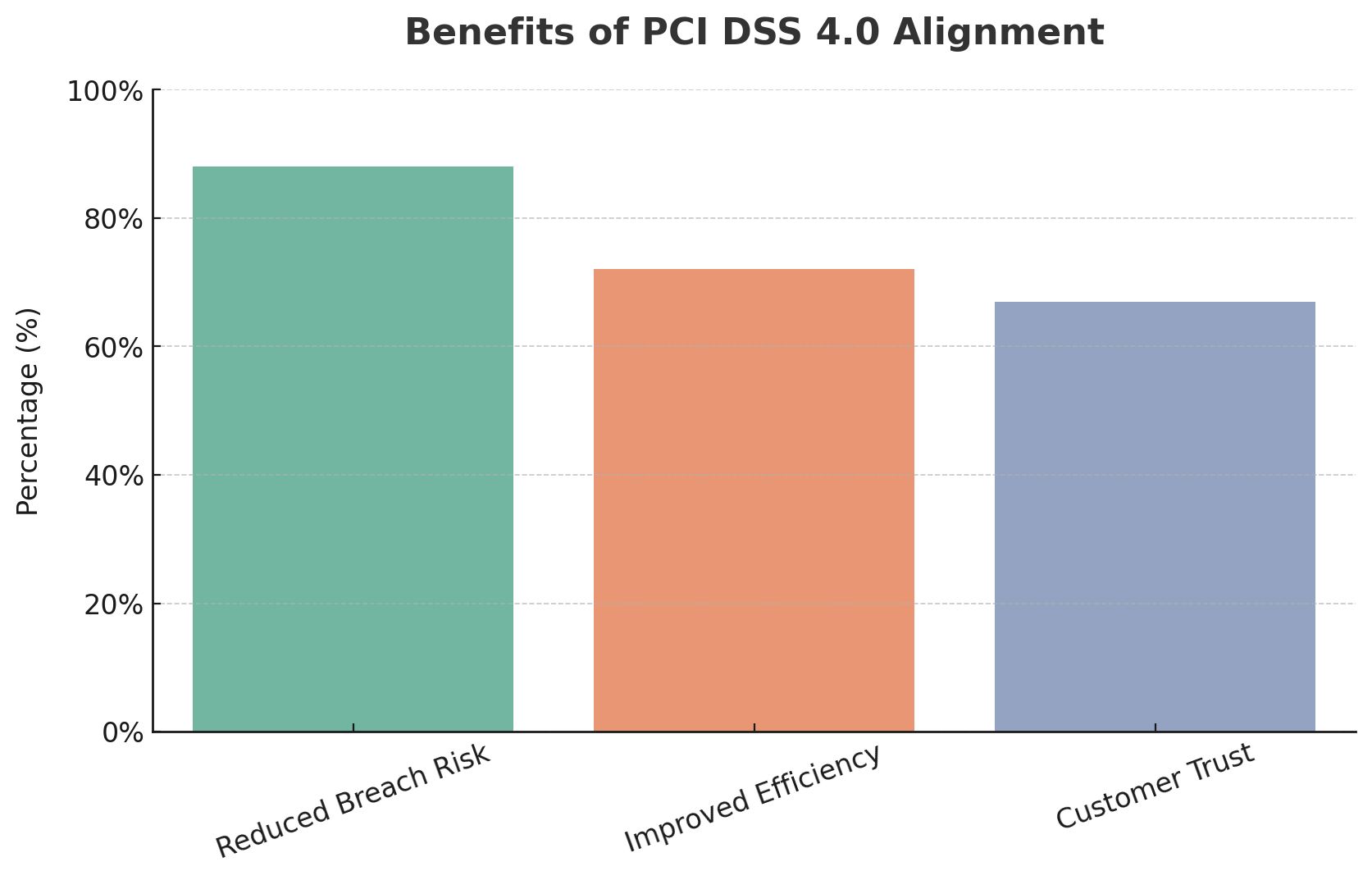

Financial services organizations face unique challenges in this transition, including legacy system integration, complex third-party relationships, and overlapping regulatory requirements. However, those that successfully align their internal controls with PCI DSS 4.0 report significant benefits beyond compliance, including reduced breach risks, improved operational efficiency, and enhanced customer trust. This whitepaper provides actionable guidance for CISOs navigating this critical transformation.

Subscribe to CybersecurityHQ Newsletter to unlock the rest.

Become a paying subscriber of CybersecurityHQ Newsletter to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Access to Deep Dives and Premium Content

- • Access to AI Resume Builder

- • Access to the Archives

Reply