- Defend & Conquer: CISO-Grade Cyber Intel Weekly

- Posts

- AI insurgency, identity crisis rising

AI insurgency, identity crisis rising

CybersecurityHQ weekly analysis

Welcome reader to your CybersecurityHQ report

Brought to you by:

🏄♀️ Upwind Security – Real-time cloud security that connects runtime to build-time to stop threats and boost DevSecOps productivity

🔧 Endor Labs – Application security for the software development revolution, from ancient C++ code to bazel monorepos, and everything in between

🧠 Ridge Security – The AI-powered offensive security validation platform

Forwarded this email? Join 70,000 weekly readers by signing up now.

—

Get annual access to our deep dives, weekly cyber intel podcast report, premium content, AI Resume Builder, and more — all for just $299. Corporate plans are now available too.

This Week in Cybersecurity: AI-Driven Chaos, Identity Heist Epidemic, and Geopolitical Cyber Assault

This week's events reveal a stark reality: digital fortresses are not just under siege, they're being outmaneuvered. The fusion of generative AI, identity exploitation, and geopolitical targeting has accelerated beyond legacy security capacity. Compromise timelines have shrunk from days to hours. This isn't an AI arms race, it's an AI insurgency, demanding a radical shift in defense.

Five Defining Threat Vectors

→ Ramnit Malware Invades ICS

Ramnit, once a banking trojan, now infiltrates Operational Technology (OT) networks. Its modularity, evasion, and credential harvesting signal a deliberate shift to bridge IT and OT, endangering industrial control systems (ICS).

Implication: The IT-OT wall has collapsed, turning financial malware into a cyber-physical safety risk.

Action: Deploy protocol-aware anomaly detection in ICS. Run breach simulations assuming IT malware hits OT endpoints. Enforce microsegmentation to isolate tiers.

→ Salesforce Vishing Attacks Weaponize Trust

Google-flagged UNC6040 impersonates Salesforce support, using fake Data Loader apps for backdoors and lateral movement via SaaS integrations.

Implication: SaaS platforms are launchpads for hybrid attacks, exploiting trust in support processes.

Action: Block unverified third-party app installs in Salesforce, Google Workspace. Use app behavior analytics to detect anomalies. Train CX teams on vishing with simulations from KnowBe4.

→ The North Face Credential Stuffing Hits 100K+

Over 100,000 North Face accounts fell to credential stuffing, fueled by AI tools correlating 184M+ leaked passwords. Retail, finance, and SaaS face relentless attacks.

Implication: AI-accelerated credential attacks are a tier-1 threat to consumer ecosystems.

Action: Enforce FIDO2 authentication on portals. Deploy behavioral biometrics for session anomalies. Audit credential reuse weekly via Have I Been Pwned.

→ Ransomware Surge Targets Critical Sectors

Ransomware like DragonForce and Play cripples healthcare and critical orgs, leaking sensitive data.

Implication: Persistent attacks disrupt operations and demand robust recovery.

Action: Prioritize off-site backups, test restoration weekly, and deploy endpoint detection to block ransomware.

→ Zero-Day Exploits Hit Broad Targets

Chrome, VPN, and WordPress (CVSS 10.0) zero-days are actively exploited, risking remote workers and web platforms.

Implication: Unpatched systems expose users to rapid compromise.

Action: Accelerate patch management, monitor exploit code via GreyNoise, and adopt zero-trust for access control.

Critical Developments

→ Google Zero-Day in Chrome Exploited: A second Q2 Chrome zero-day triggered an emergency patch, with active exploits targeting users.

→ ASUS Router Backdoor Campaign: 9,000+ routers hit via a patched bug, exposing unpatched consumer devices.

→ vBulletin Exploited Again: Fresh exploits hit the legacy forum platform, a supply chain weak link.

→ Victoria's Secret Breach Delays Earnings: Sensitive system exposure forced a deferral, disrupting operations.

→ Ransomware Surge: DragonForce exploits SimpleHelp for ransomware; Play hits 900 victims, including critical orgs.

→ Microsoft and CrowdStrike Threat Actor Glossary: A unified taxonomy aids cross-industry threat intelligence amid attribution chaos.

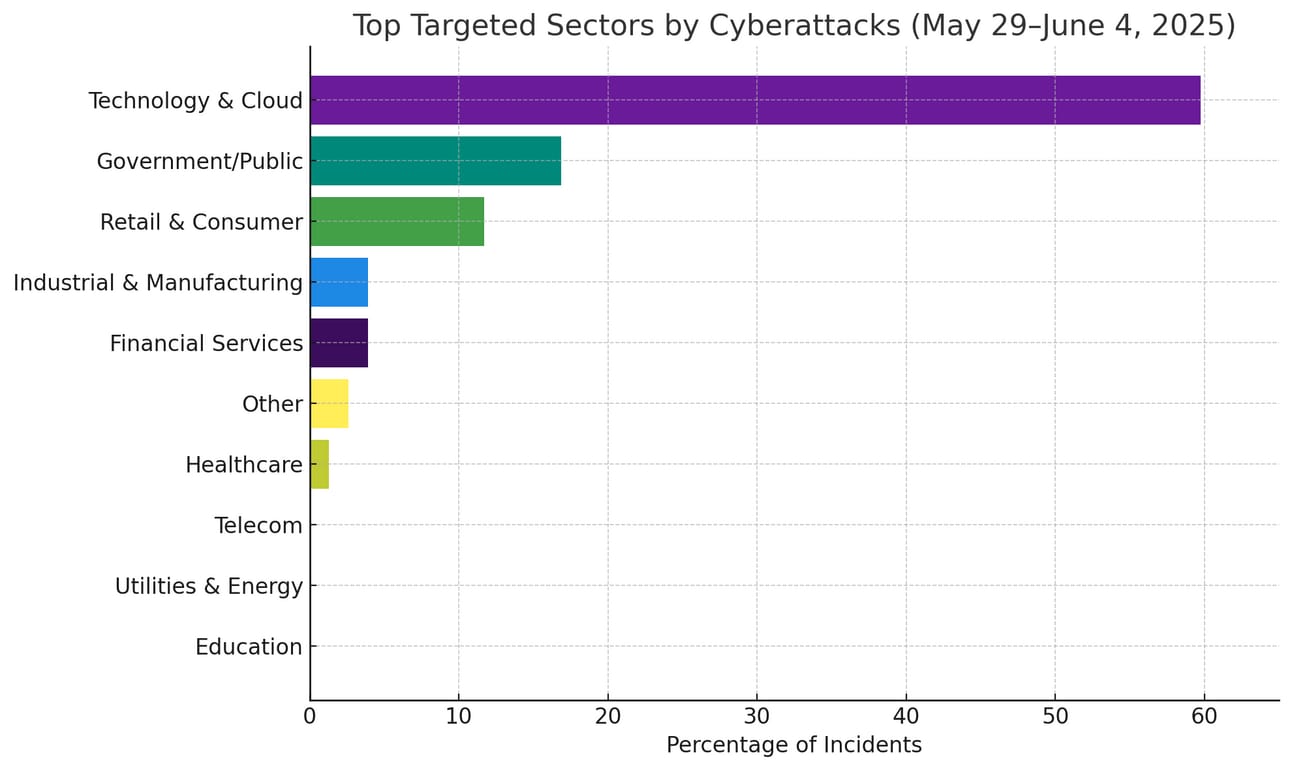

Key Metrics This Week

→ AI-Driven Scans: 36,000 per second

→ Passwords Exposed: 184M+ in plain text

→ Ransomware Victims: 900 orgs hit by Play

→ Compromised Devices: 9,000+ ASUS routers backdoored

→ Geopolitical Impact: 60% of orgs' cyber strategies affected

Insight: These numbers show the scale and speed of threats, urging immediate action.

Strategic Guidance for Cybersecurity Leaders

→ AI Security Starts with Scope Control: Box AI agents, limit tasks, and monitor with sandboxing APIs. Treat generative agents as potential rogue code near critical systems.

→ Identity Must Become Dynamic: Static credentials are obsolete. Use session risk scoring, continuous re-authentication, and biometric-verbal fusion for high-risk actions.

→ Decouple Trust from Communication Channels: Voice, SMS, and video are spoofable. Embed trust in out-of-band systems for verification.

→ Security is a Data Problem: Unify EDR, NDR, IAM, and SaaS logs into AI-driven platforms for streaming inference, not batch analytics.

→ Geopolitics is Cyber Risk: China's APT41 targets SAP, SQL Server across Asia, Brazil; China-Russia cyber ties grow. Meta disrupts influence ops in Romania, Azerbaijan, Taiwan. Suspected nation-state actors hit ConnectWise. If your supply chain spans Taiwan, Ukraine, Brazil, U.S., or Eastern Europe, you're a target.

Action: Map supply chain risks, subscribe to CISA and threat intel feeds, and simulate APT scenarios for critical assets.

Australia mandates ransomware payment reporting, while U.S. DoJ seizes cybercrime domains. Breaches at Victoria's Secret and Cartier trigger data protection scrutiny.

Implication: Non-compliance risks fines, reputational loss amid rising attacks.

Action: Align with GDPR, CCPA, and local laws; log ransomware incidents for reporting; consult legal teams for audits.

Toolbox for the AI Insurgency

→ Anomaly Detection: Nozomi Networks and Dragos for ICS; GreyNoise for exploit tracking.

→ Identity Security: Okta for risk scoring; YubiKey for FIDO2; BioCatch for biometrics.

→ Unified Analytics: Splunk for real-time logs; Databricks for AI-driven inference.

→ Incident Response: CrowdStrike for endpoints; Zscaler for zero-trust access.

Approach: Prioritize cloud-native, scalable tools. Test integration in 48 hours to match attack speed.

Market Signal: Security's Next Consolidation Wave

→ Zero Networks Raises $55M: Microsegmentation shrinks attack surfaces, a winning bet.

→ ThreatSpike $14M Series A: UK's ThreatSpike shifts endpoint security to continuous behavioral modeling.

→ Unbound Raises $4M: Seed funding fuels AI-safe APIs, sandboxing, and data provenance.

→ Salesforce Acquires Moonhub: Salesforce buys Moonhub, a startup building AI tools for hiring, boosting secure talent management and insider threat prevention.

→ Leidos Boosts Cyber Arsenal: Leidos buys Kudu Dynamics, a cybersecurity firm specializing in vulnerability research and cyber-electronic warfare, for $300M to bolster AI-driven threat detection and defense capabilities.

→ CACI Secures Intelligence Contracts: CACI lands $640M in contracts, fueling intelligence-driven cyber operations for government and critical sectors.

Final Signal: You're Not Behind, You're Blind

Adversaries are inside, leveraging zero-friction AI attacks. Perimeters are illusions, dashboards breed overconfidence, and detection lags. Winners won't be the best protected, they'll be the most adaptive, architecting real-time, human-centric, geopolitically aware security.

Leadership Imperative

Assume breach, design for speed, and treat trust as radioactive. In a world where attackers see all and defenders see only logs, blend AI defenses, dynamic identity, and unified data to outpace the insurgency.

Cyber Threats & Attack Trends

CybersecurityHQ: This Week's Reports Derived from Technical Research Papers and Briefings

🔒 Pro subscriber-only 🔒

Developing cost-effective budgeting strategies for quantum technology–induced regulatory transformations 👉 Read the report

Using predictive modeling to map cybersecurity breach cascades in enterprise network infrastructures 👉 Read the report

Mapping and mitigating interdependent cybersecurity risks in complex technology ecosystems 👉 Read the report

And more inside - check out the full list here.

Cyber Intel Brief: Key Insights from Leading Security Podcasts

This is what you missed in this week’s Cyber Intel Report sourced from top cybersecurity podcasts and webinars, if you haven’t upgraded your membership: critical insights, expert takes, and the latest threats unpacked. Don’t let this slip by—upgrade today to get the full scoop!

⤷ SentinelOne outage reveals fragile XDR dependence across 13,000 organizations

⤷ Australia mandates ransomware payment disclosures—global compliance trends to follow

⤷ Deepfake audio spoofs executives in real-time to bypass financial approvals

⤷ AI hiring pipelines face legal backlash as Workday hit with resume bias lawsuit

And more insights in this week’s full CISO briefing.

Interesting Read

U.S. Rebrands AI Safety Institute, Shifts to National Security Focus

On June 3, 2025, the U.S. government rebranded the AI Safety Institute as the Center for AI Standards and Innovation (CAISI), marking a sharp pivot from general AI risk mitigation to prioritizing national security threats. The revamped center will focus on cyber, biosecurity, chemical weapon risks, and foreign influence, particularly from adversarial AI systems like those from China.

The move reflects a broader policy shift toward deregulation and accelerated AI adoption, including controversial support for coal-powered data centers and a proposed 10-year moratorium on state-level AI laws. For CISOs, this signals a regulatory environment in flux, with less oversight, faster innovation, and growing reliance on security teams to self-govern AI risk exposure.

Fresh From the Field: Security Resources You Can Use

Title | Publisher | Focus | Direct Access Link |

|---|---|---|---|

Exposing the Impact of GenAI for Cybercrime: An Investigation into the Dark Side | University of Cincinnati | Generative AI, Cybercrime, Technological Amplification | |

Securing the Future of Agentic AI: Governance, Cybersecurity, and Privacy Considerations | Office of the CISO, Google Cloud | AI Governance, Cybersecurity, Privacy | |

Navigating the Evolving Cybersecurity Landscape: Threats, Trends, and Strategic Response | Cybersec Europe | Geopolitics, Threat Intelligence, Cyber Strategy |

Charles B. Wang Community Health Center

New York City Metropolitan Area, US

CIO Advisory, Partner Consulting

Cognizant

Charlotte, NC, US

Peraton

Arlington, VA, US

Principal Enterprise Network Architect (Remote)

Crowdstrike

Remote (Sunnyvale, CA, US)

Principal, U42 Strategy and Programs

Palo Alto Networks

New York, NY, US

Chief Privacy & Information Risk Officer

Umpqua Bank

Bellevue, WA, US

Varonis

Morrisville, NC, US

Senior Business Analyst - Technology Risk Management

Capital One

New York, NY, US

IBM

Dallas, TX, US

Stay safe, stay secure.

The CybersecurityHQ Team

Reply